JSC National Atomic Company “Kazatomprom” (“Kazatomprom”, “KAP” or “the Company”) announces the following operations and trading update for the third-quarter and nine-months ended 30 September 2020.

This update provides a summary of recent developments in the uranium industry, provisional information related to the Company’s key third-quarter and nine-month operating and trading results, and reiterated 2020 guidance. The information contained in this Operations and Trading Update may be subject to change.

Market Developments

The COVID-19 pandemic had a profound global impact thus far in 2020, with governments trying to slow the spread of the virus by imposing restrictions on the movement of people, and by implementing regional and nationwide lockdowns. Companies have been doing their part by implementing mandatory social distancing and undertaking strict disinfection procedures at their factilities and offices, with a widespread move of administrative personnel to remote working practices. In the third quarter, although governments eased lockdowns and companies and their employees continued to adapt to COVID-related restrictions, businesses, including those in the nuclear fuel supply chain, have been adjusting and preparing to deal with additional waves of increased infection rates.

Similar to the second quarter, the nuclear market’s focus throughout the third quarter of 2020 continued to be on the supply-side impacts of the pandemic. Kazatomprom remobilized employees to its operations during the first half of August, which was carried out following strict health and safety protocols to minimize the risk of a site or community outbreak. Wellfield development and project activities have now resumed, though production levels for the second half of the year are expected to be impacted by the four-month halt of mine development that began in the second quarter (for details on the impact on Kazakhstan’s production, see Company Developments section below).

In September, Cameco Corporation and Orano Canada restarted operations at the Cigar Lake mine and McClean Lake mill in northern Saskatchewan, Canada, which were completely suspended due to the pandemic. Although the companies withdrew most non-production guidance metrics due to uncertainty, they disclosed that Cigar Lake is only expected to produce about 4,000 tU (about 10.6 million pounds) in 2020, compared to the previous plan of 6,900 tU (18.0 million pounds).

There have been very few published details regarding the ongoing operational status of mines in other uranium-producing jurisdictions, such as Namibia, Niger, Australia, Russia and Uzbekistan, though for the most part, 2020 volumes are expected to be lower than initially planned, across the board. Taken together, the impact of the actions taken by the world’s uranium producers is expected to result in a 2020 primary supply reduction of up to 14% compared to 2019 (according to third-party sources), pushing supply-demand into an annual deficit (compared to the previous expectation of 2020 being roughly in balance).

Similar to producers, nuclear utilities also spent a significant amount of time in the third quarter strengthening their operational resilience in the face of COVID-19. Reactor operators undertook similar actions to protect their employees and local communities. Nuclear generally played an important role in ensuring the availability of safe, clean and low-cost baseload electricity for hospitals, transportation, homes, and other essential services.

Unrelated to COVID-19, but impacting future supply, Kazatomprom announced in August that it would be continuing to flex down production by 20% through 2022, compared to the planned levels under Subsoil Use Contracts. The full implementation of the decision to extend the reduction for an additional year would remove up to 5,500 tU from anticipated global primary supply in 2022, with uranium production in Kazakhstan staying similar to the level expected in 2021.

While COVID-related announcements dominated news feeds throughout the third quarter, there were also a number of non-pandemic-related demand-side developments:

- Emirates Nuclear Energy Corporation announced that in August, its operations and maintenance subsidiary, Nawah Energy Company, safely and successfully connected unit 1 of the Barakah Nuclear Energy Plant to the United Arab Emirates electricity grid.

- China National Nuclear Corporation (CNNC) announced that unit 5 of the Tianwan nuclear power plant located in China's Jiangsu province, was connected to the grid in August, marking a major milestone for the 1080 MWe domestically-designed ACPR1000 pressurized water reactor. CNNC also announced that the pouring of the first safety-related concrete began for Zhangzhou-2, at the Zhangzhou nuclear power plant in China's Fujian province. Zhangzhou-2 is the second Hualong One unit under construction (HPR-1000, domestically designed reactor for export), and it is scheduled to enter commercial operation in 2025.

- China’s cabinet approved four new nuclear power units in the coastal provinces of Hainan and Zhejiang, Changjiang Phase II (units 3 and 4) and Sanao Phase I (units 1 and 2), respectively. Changjiang Phase II is under development by CNNC and China Huaneng Group, whereas Sanao Phase I is under development by CGN. Both projects are comprised of Hualong One (HPR-1000) reactors.

- In Mexico, the Ministry of Energy renewed Comisión Federal de Electricidad’s (CFE) operating license for unit 1 of Laguna Verde, the country’s sole nuclear plant, for another 30 years until 2050.

- Spain’s Ministry for Ecological Transition extended the operating licence for units 1 and 2 at the Almaraz NPP in Cáceres, and for the Vandellós II plant in Tarragona. Operation of Almaraz unit 1 and 2 were extended until 2027 and 2028 respectively. The Vandellós II plant is now licensed to operate for an additional ten years, until 2030.

- In the Czech Republic, the State Office for Nuclear Safety extended the operating license for unit 1 of České Energetické Závody’s (ČEZ) Temelin plant for an additional ten years, until 2030.

- The government of Poland announced plans to invest US$40 billion in the construction of six nuclear reactors over the next 20 years. Poland is aiming to cut its dependence on coal (currently fuels about 75% of Polish electricity generation), and generate half of its electricity from zero-emission sources by 2040. Work on the first reactor is expected to begin in 2026, with a target of entering service in 2033.

Partially offsetting the positive global nuclear generation developments, there were also a few decommissioning and early closure announcements:

- NextEra’s Duane Arnold nuclear plant in Iowa, USA, is expected to be decommissioned early due to storm damage. The 601 MWe boiling water reactor was previously set to be decommissioned at the end of October 2020.

- Exelon Generation announced that it intends to retire its Byron and Dresden plants in the second half of 2021, due to a lack of financial support for zero-carbon generation sources, which will result in revenue shortfalls in the hundreds of millions of dollars. The early shutdown would result in the loss of four nuclear generation units. Dresden is licensed to operate for another decade, while Byron could continue operating for 20 more years.

- EDF Energy has decided that its Hunterston B power station in Ayrshire, Scotland, will move into the defuelling phase no later than January 2022, given the age of the station. In 2012, the generating life of the reactor was extended to March 2023 (+/- two years).

In key policy news, the US extended the remaining sanctions waiver covering companies working on the Bushehr-1 nuclear power plant in Iran, for 90 days (until late November 2020).

In October, the US Department of Commerce and Rosatom signed a final amendment to the Agreement Suspending the Antidumping Investigation on Uranium from the Russian Federation (known as the Russian Suspension Agreement, or RSA). This amendment extends the Agreement through 2040 and reduces US reliance on uranium and fuel-cycle services from Russia throughout that timeframe. Under the amended Agreement, annual limitations will be in place for all parts of the nuclear fuel cycle (not just enrichment), and total Russian uranium exports are expected to satisfy an average of approximately 17% of US enrichment demand annually over the next 20 years (no greater than 15% starting in 2028).

Spot Market

Spot activity slowed down markedly in the third quarter, compared to the second quarter of 2020. However, monthly transaction volumes were slightly higher than average. The weakened activity during the third quarter led to a gradual drop of the spot price, from about US$33.00 per pound in June, to just under US$30.00 per pound by the end of the quarter.

According to third-party market data, spot volumes transacted over the first nine months of 2020 were about 60% higher than the same period last year, with nearly 65 million pounds U3O8 (24,750 tU) transacted at an average weekly spot price of US$29.56 per pound (compared to about 40 million pounds U3O8 (15,300 tU) at an average weekly spot price of US$26.07 per pound during the first nine months of 2019). Intermediaries dominated both the buy- and sell-sides of the third quarter transactions, with a significant decline in the contracting activity of producers and utilities over the summer.

Long-term Market

In the term market, third-party data indicated that contracted volumes totaled nearly 35 million pounds U3O8 (13,400 tU) through the first nine months of 2020 (compared to about 68 million pounds U3O8 (26,150 tU) during the same period last year). Term market interest picked up slightly to a moderate level in the third quarter, resulting in a decrease of the average long-term price by US$0.50, to US$35.00 per pound U3O8 (average of term price reported on a monthly basis by third-party sources).

The majority of the term activity to date in 2020 has been from US utilities looking at current market developments and deciding to secure fuel for the next decade.

Company Developments

Resumption of development activity

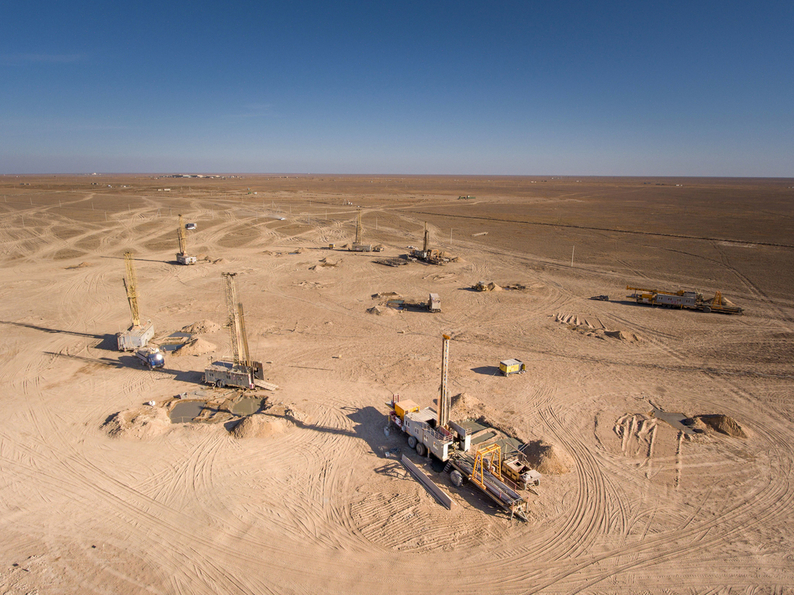

Activities at all of Kazatomprom’s mining operations have resumed and progressed according to the Company’s plans. Of particular note, wellfield development drilling and the associated work to bring on new wellfields, began to ramp up in August 2020, following a four-month reduction of non-essential staff at the outset of the COVID-19 pandemic. Drilling at the majority of the Company’s operations is primarily carried out by Kazatomprom’s exploration and drilling subsidiary, Volkovgeology JSC, supplemented by private drilling contractors as required. Kazatomprom is efficiently and effectively managing the distribution of drills and personnel according to annual mine plans for each operation, as required, to deliver on the Company’s pandemic-adjusted 2020 production plans.

At this point in 2020, if wellfield development were to encounter availability, pandemic- or weather-related issues, it could impact reserve development and production plans for 2021, though it would not influence 2020 production volumes. Kazatomprom’s production guidance for 2020 remains unchanged at 19,000 tU – 19,500 tU on a 100% basis (10,500 tU – 10,800 tU Kazatomprom attributable share).

COVID-19 cases at Semizbai-U

Despite the Company’s mandatory COVID-19 testing protocols, with site quarantine practices and frequent disinfection efforts, at the end of October, an employee who had previously tested negative upon arriving for shift change, presented symptoms while at work at JV Semizbai-U LLP, an operation in the Akmola region. Subsequent to the employee testing positive, re-testing was carried out on 183 employees and contractors working at the operation; including the initial case, a total of 46 positive cases were returned. The Company is working with health authorities to ensure the affected employees are quarantined and isolated according to Government protocols, with contact tracing currently underway. All employees with positive results have been placed in a specialized regional hospital with any immediate contacts that have tested negative being isolated in a regional sanatorium. The company is taking all necessary measures to ensure the health and wellbeing of personnel both on and off site, and based on the layout of the camp and separation between wellfield development and production staff, production and drilling activities are not expected to be impacted at this time.

The Company will continue to monitor the situation at Semizbai and at all other operations, and will follow national and regional COVID-19 developments and governmental directives, to ensure that any required actions to reduce the spread and/or impact of the pandemic are implemented without delay.

Advanced stage exploration projects

As per the Competent Person’s Report included in the 2018 IPO prospectus, the Company had four advanced-stage exploration projects with exploration contracts, valid for up to five years and issued by the Ministry of Energy of the Republic of Kazakhstan, all set to expire in 2021-2022. Prior to the completion of the exploration phases at each of the advanced prospects, a decision must be taken to either abandon the prospect, or to advance the project to a pilot mining phase. Pilot production would be followed by commercial production, according to each project’s production contract (equivalent to a “mine licence”).

Joint Venture Budenovskoye LLP (“JV Budenovskoye”) obtained a production contract in October 2020, providing for the commencement of pilot production totaling 321 tU. The JV has up to four years to complete the pilot production phase.

The timing of further commissioning plans and future annual production volumes will be determined by the JV’s General Meeting of Participants and negotiated with the Ministry of Energy of the Republic of Kazakhstan, to be finalised prior to the expiration of the pilot production period.

Kazatomprom’s Operational Results1

|

|

Three months ended September 30 |

Change |

Nine months ended September 30 |

Change |

||

|

(tU as U3O8 unless noted) |

2020 |

2019 |

2020 |

2019 |

||

|

Production volume (100% basis)2 |

4,657 |

6,082 |

(23)% |

15,091 |

16,882 |

(11)% |

|

Production volume (attributable basis)3 |

2,518 |

3,617 |

(30)% |

8,309 |

9,844 |

(16)% |

|

Group sales volume4 |

5,638 |

2,577 |

119% |

9,857 |

8,002 |

23% |

|

KAP sales volume (incl. in Group)5 |

4,975 |

2,308 |

116% |

8,724 |

6,917 |

26% |

|

KAP average realized price (USD/lb U3O8)6* |

30.45 |

27.78 |

10% |

29.58 |

27.59 |

7% |

|

Average month-end spot price (USD/lb U3O8)7* |

31.08 |

25.45 |

22% |

30.00 |

25.83 |

16% |

1 All values are preliminary.

2 Production volume (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it therefore disregards the fact that some portion of that production may be attributable to the Group’s joint venture partners or other third party shareholders. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

3 Production volume (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, which corresponds only to the size of such interest; it therefore excludes the remaining portion attributable to the JV partners or other third party shareholders, except for production from JV “Inkai” LLP, where the size of the interest and share of production differ.

4 Group sales volume: includes Kazatomprom’s sales and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group’s returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity).

5 KAP sales volume (incl. in Group): includes only the total external sales of KAP HQ and Trade House KazakAtom AG (THK). Intercompany transactions between KAP HQ and THK are not included.

6 KAP average realized price: the weighted average price per pound for the total external sales of KAP HQ and THK. The pricing of intercompany transactions between KAP HQ and THK are not included.

7 Source: UxC, TradeTech. Values provided represent the average of the uranium spot prices quoted at month end, and not the average of each weekly quoted spot price. Contract price terms generally refer to a month-end price.

* Note that the conversion of kgU to pounds U3O8 is 2.5998.

On both a 100% and attributable basis, production volumes for the third quarter and first nine months of 2020 were lower, related to the expected impact of the pandemic, and the Company’s decreased wellfield development activity and lower staff levels throughout the second quarter. There is a four- to eight-month lag between the wellfield development phase and production phase of the in-situ recovery mining process and as a result, the safety measures implemented during the first half of 2020 are expected to predominantly impact the second half of the year.

The year-over-year increase in uranium sales at both the Group and KAP levels was due to seasonality and differences in the customer-requested timing of deliveries in 2019 and 2020.

The rising uranium spot price had a positive impact on Kazatomprom’s average realized price, which increased in the third quarter and nine months of 2020. If spot prices in 2020 remain higher than in 2019, the trend of increasing realized price is expected to continue, with the Company’s fourth-quarter delivery schedule expected to be slightly higher than the third quarter.

Kazatomprom’s 2020 Guidance

|

(exchange rate 450 KZT/1USD) |

2020 |

|

Production volume U3O8 (tU) (100% basis)1 |

19,000 – 19,5002 |

|

Production volume U3O8 (tU) (attributable basis)3 |

10,500 – 10,8002 |

|

Group sales volume (tU) (consolidated)4 |

15,500 – 16,500 |

|

Incl. KAP sales volume (incl. in Group) (tU)5 |

13,500 – 14,500 |

|

Revenue - consolidated (KZT billions)6 |

580 – 600 |

|

Revenue from Group U3O8 sales, (KZT billions)6 |

460 – 510 |

|

C1 cash cost (attributable basis) (USD/lb)* |

$10.00 - $11.00 |

|

All-in sustaining cash cost (attributable C1 + capital cost) (USD/lb)* |

$13.00 - $14.00 |

|

Total capital expenditures of mining entities (KZT billions) (100% basis)7 |

65 - 75 |

1 Production volume (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it disregards that some portion of production may be attributable to the Group’s JV partners or other third-party shareholders.

2 The duration and full impact of the COVID-19 pandemic is not yet known. Annual production volumes could therefore vary from our expectations, depending on the actual impact.

3 Production volume (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, corresponding only to the size of such interest; it excludes the portion attributable to the JV partners or other third-party shareholders, except for JV “Inkai” LLP.The Company anticipates that the annual share of production in JV “Inkai” LLP in 2020 will be approximately 1,066 tU. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 Group sales volume: includes Kazatomprom’s sales and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group’s returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity)

5 KAP sales volume: includes only the total external sales of KAP HQ and THK. Intercompany transactions between KAP HQ and THK are not included.

6 Revenue expectations are based on uranium prices and KZT-to-USD exchange rate taken at a single point in time from third-party sources. The prices and KZT-to-USD exchange rate used do not reflect any internal estimate from Kazatomprom, and 2020 revenue could be materially impacted by how actual uranium prices and KZT-to-USD exchange rate vary from the third-party estimates.

7 Total capital expenditures (100% basis): includes only capital expenditures of the mining entities.

* Note that the conversion of kgU to pounds U3O8 is 2.5998.

All 2020 guidance remains unchanged. Revenue, C1 cash cost (attributable basis) and All-in Sustaining cash cost (attributable C1 + capital cost) may vary from the ranges shown, to the extent that the KZT-to-USD exchange rate and uranium spot price differ from the assumptions shown in the footnotes.

Note that the Company only expects to update annual guidance in relation to operational factors and internal changes that are within its control. Key assumptions used for external metrics, including exchange rates and uranium prices, are established in consultation with the major shareholder (Samruk-Kazyna), and from third party sources during the Company’s annual budget process, respectively. Such assumptions will only be updated on an interim basis in exceptional circumstances.

The Company continues to target an ongoing inventory level of approximately six to seven months of annual attributable production. However, inventory levels are expected to fall below that level in 2020 and 2021, with no opportunity to catch up the recent production losses in these future periods. As such, the Company will continue to monitor market conditions for opportunities to optimise its inventory levels, and it has purchased small volumes in the spot market during the second and third quarters.

For further information, please contact:

Kazatomprom Investor Relations Inquiries

Cory Kos, Director of Investor and Public Relations

Tel: +7 (8) 7172 45 81 80

Email: ir![]() kazatomprom.kz

kazatomprom.kz

Kazatomprom Public Relations and Media Inquiries

Torgyn Mukayeva, Deputy Director of Investor and Public Relations

Tel: +7 (8) 7172 45 80 63

Email: pr![]() kazatomprom.kz

kazatomprom.kz

About Kazatomprom

Kazatomprom is the world's largest producer of uranium, with the company’s attributable production representing approximately 24% of global primary uranium production in 2019. The Group benefits from the largest reserve base in the industry and operates, through its subsidiaries, JVs and Associates, 24 deposits grouped into 13 mining assets. All of the Company’s mining operations are located in Kazakhstan and mined using ISR technology with a focus on maintaining industry-leading health, safety and environment standards.

Kazatomprom securities are listed on the London Stock Exchange and Astana International Exchange. As the national atomic company in the Republic of Kazakhstan, the Group's primary customers are operators of nuclear generation capacity, and the principal export markets for the Group's products are China, South and Eastern Asia, Europe and North America. The Group sells uranium and uranium products under long-term contracts, short-term contracts, as well as in the spot market, directly from its headquarters in Nur-Sultan, Kazakhstan, and through its Switzerland-based trading subsidiary, Trade House KazakAtom AG (THK).For more information, please see our newly updated website at http://www.kazatomprom.kz

Forward-looking statements

All statements other than statements of historical fact included in this communication or document are forward-looking statements. Forward-looking statements give the Company’s current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,” “project,” “will,” “can have,” “likely,” “should,” “would,” “could” and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the Company’s control that could cause the Company’s actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which it will operate in the future. THE INFORMATION WITH RESPECT TO ANY PROJECTIONS PRESENTED HEREIN IS BASED ON A NUMBER OF ASSUMPTIONS ABOUT FUTURE EVENTS AND IS SUBJECT TO SIGNIFICANT ECONOMIC AND COMPETITIVE UNCERTAINTY AND OTHER CONTINGENCIES, NONE OF WHICH CAN BE PREDICTED WITH ANY CERTAINTY AND SOME OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. THERE CAN BE NO ASSURANCES THAT THE PROJECTIONS WILL BE REALISED, AND ACTUAL RESULTS MAY BE HIGHER OR LOWER THAN THOSE INDICATED. NONE OF THE COMPANY NOR ITS SHAREHOLDERS, DIRECTORS, OFFICERS, EMPLOYEES, ADVISORS OR AFFILIATES, OR ANY REPRESENTATIVES OR AFFILIATES OF THE FOREGOING, ASSUMES RESPONSIBILITY FOR THE ACCURACY OF THE PROJECTIONS PRESENTED HEREIN. The information contained in this communication or document, including but not limited to forward-looking statements, applies only as of the date hereof and is not intended to give any assurances as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to such information, including any financial data or forward-looking statements, and will not publicly release any revisions it may make to the Information that may result from any change in the Company’s expectations, any change in events, conditions or circumstances on which these forward-looking statements are based, or other events or circumstances arising after the date hereof.